Your Business’s Response to COVID-19

03.19.2020 Written by: Henningson & Snoxell, Ltd.

With RSS feeds, you don't have to visit our site everyday to keep up to date. Simply subscribe to our blog via RSS or Email and our posts will come to you!

03.19.2020 Written by: Henningson & Snoxell, Ltd.

12.18.2019 Written by: Henningson & Snoxell, Ltd.

Over the past week, I’ve responded to several clients’ emails and phone calls regarding an official-looking form they received in the mail. This form appeared to be a notice for renewing their Minnesota entity status and asked for a payment of $95.00 to be mailed in along with the filled out form.

(more…)10.15.2019 Written by: Henningson & Snoxell, Ltd.

10.04.2019 Written by: Henningson & Snoxell, Ltd.

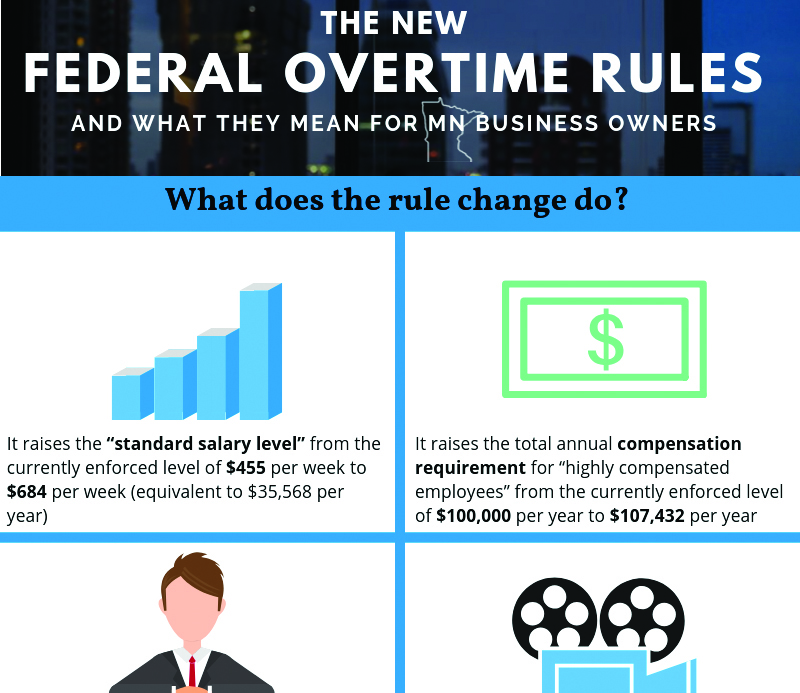

Infographic created with information from this blog post.

09.24.2019 Written by: Henningson & Snoxell, Ltd.

09.24.2019 Written by: Henningson & Snoxell, Ltd.

In May of this year, legislation was passed investing $3.1 million in new funding to the Department of Labor and Industry’s efforts to enforce state wage and hour laws over the next two years. The new wage theft law contains several different provisions that can be overwhelming for employers to boil down to understand exactly what they need to do to comply.

Unlike other labor laws, the MN Wage Theft Law covers ALL EMPLOYERS. It does not matter whether an employer is a one-man shop in Lismore, Minnesota or a 300 non-profit organization in Maple Grove, Minnesota. With DLI’s increased funding for enforcement activities, it is critical that employers are in compliance.